Introduction To Fast Invoice Factoring:

In the present fast-paced business climate, overseeing income is essential for organizations, everything being equal. Little and medium-sized organizations (SMBs) frequently face the test of deferred installments from clients, which can make critical income holes. This is where fast invoice factoring becomes an integral factor. Invoice factoring is a monetary help that permits organizations to offer their extraordinary invoices to an outsider, known as a component, in return for guaranteed cash. The component then, at that point, takes care of gathering the installment from the client. Fast invoice factoring is explicitly intended to furnish organizations with speedier admittance to reserves, frequently inside 24 to 48 hours, assisting with overcoming any barrier among invoicing and installment.

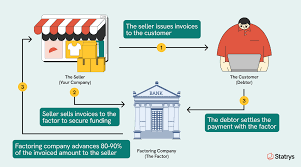

How Fast Invoice Factoring Functions

The course of fast invoice factoring is moderately clear. A business offers its neglected invoices to a factoring organization at a limited rate, typically between 70% to 90% of the all out invoice esteem. The factoring organization then, at that point, propels the business the settled upon level of the invoice esteem right away. When the client settles the invoice, the factoring organization pays the business the excess equilibrium, less a factoring expense. The vital advantage of this framework is that organizations get fast money without sitting tight for the average installment terms, which could reach out from 30 to 90 days or more. This quick implantation of capital assists organizations with keeping up with smooth tasks, pay merchants, and oversee finance without interferences.

Benefits of Fast Invoice Factoring

One of the significant benefits of fast invoice factoring is that it furnishes organizations with prompt liquidity, permitting them to stay away from the pressure of income issues. Conventional advances and credit extensions might take more time to get and require a decent financial record, while factoring is more centered around the worth of the invoices and the unwavering quality of the client paying those invoices. This makes factoring an appealing choice for organizations with not exactly wonderful credit or those that are needing fast money to quickly jump all over development chances. Moreover, invoice factoring is an adaptable funding arrangement, meaning organizations can factor invoices depending on the situation, contingent upon their income needs, without being attached to a drawn out responsibility or exorbitant loan fees.

Who Can Profit from Fast Invoice Factoring?

Fast invoice factoring is great for organizations that arrangement with clients who have expanded installment terms. Businesses, for example, staffing, assembling, transportation, and discount dissemination frequently observe factoring to be a useful instrument, as their clients might take more time to pay for labor and products. For instance, a staffing organization might need to sit tight for 30 to 60 days prior to getting installment from a client, despite the fact that the office needs to quickly pay its transitory specialists. By factoring their invoices, the office can stay away from the income press and guarantee its tasks moved along as planned. Independent ventures, new businesses, and organizations that are encountering quick development likewise stand to profit from this type of supporting as they work to scale tasks without being kept down by sluggish paying clients.

Contemplations While Utilizing Fast Invoice Factoring

While fast invoice factoring can be a help for organizations needing speedy money, it’s vital to gauge the expenses and terms related with the help. Factoring expenses, which ordinarily range from 1% to 5% each month, can include up depending the volume and timeframe an invoice stays neglected. Moreover, organizations should know that factoring organizations might charge extra expenses for administrations like credit checks, assortments, and record the executives. It’s fundamental for entrepreneurs to painstakingly survey factoring arrangements to guarantee they grasp the terms and to decide if the expenses are legitimate by the quick liquidity and accommodation factoring gives. Besides, the factoring organization will frequently assess the reliability of a business’ clients prior to consenting to buy invoices, so organizations need to work with clients who have a strong installment history.

The Job of Innovation in Fast Invoice Factoring

Lately, the appearance of innovation has smoothed out the course of fast invoice factoring. Many factoring organizations currently offer internet based stages that permit organizations to submit invoices, track installments, and deal with their records carefully. This has made invoice factoring more open and proficient, especially for organizations that might not have the opportunity or assets to participate in extended administrative work and calls. Innovation additionally empowers faster handling times, for certain stages ready to deliver assets promptly after getting the invoice. Therefore, organizations can all the more actually deal with their income and spotlight on developing their activities as opposed to stressing over deferred installments. The incorporation of simulated intelligence and information investigation is likewise assisting factoring organizations with evaluating the gamble of invoices all the more precisely, which can prompt better terms for organizations.

Conclusion: A Significant Monetary Device for Organizations

All in all, fast invoice factoring is a viable answer for organizations that need quick money to keep up with tasks, cover bills, and asset development. By offering neglected invoices to a factoring organization, organizations can acquire fast admittance to assets without the postponements and necessities related with customary credits. While there are expenses and contemplations included, for example, factoring charges and the need to guarantee the reliability of clients, the adaptability and speed presented by fast invoice factoring can be important, particularly in businesses with slow-paying clients. With the assistance of present day innovation, invoice factoring has become more open and proficient, making it an alluring funding choice for organizations hoping to remain serious in a fast-moving business sector.